News & Insights

KGAL commits to being climate-neutral asset manager by 2021

As part of a new climate strategy, one of the leading German asset managers is also targeting net zero emission portfolio by 2050 – German investment manager KGAL has committed to becoming a climate-neutral company by the beginning of 2021 by offsetting all greenhouse gas emissions connected to its operations. Emissions calculated per employee will be reduced by 5% annually during the next 10 years. It has also pledged to have a net zero emission investment portfolio by 2050. The targets are set out in the company’s newly announced climate strategy.

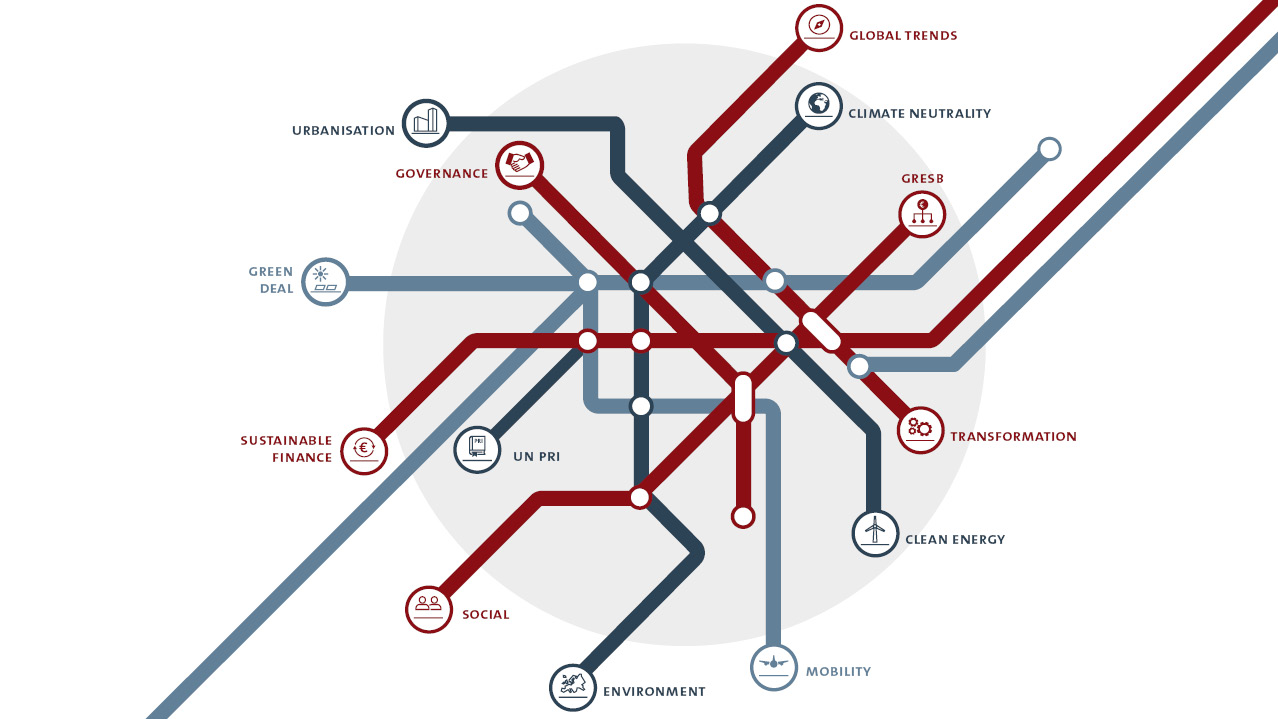

The strategy of the KGAL Group (“KGAL”) is in line with both the Paris Climate Agreement and official European, as well as German, long-term climate goals which are aimed at limiting the increase in the global average temperature to below 2°C and to deliver a carbon-neutral economy by 2050. The new strategy builds upon KGAL’s signing of the UN PRI in 2018, and its 2010 mission statement which explicitly incorporated environmental protection requirements into the company’s goals.

KGAL CEO, Gert Waltenbauer, comments: “Living up to our mission statement means offering sustainable products for our investors, but also becoming a sustainable asset manager that contributes to a sustainable society”.

KGAL already considers climate-related factors on all levels of its business operations. In 2019, it was able to reduce its own emissions of around 1,700 tonnes of CO2 by 13% on a year-on-year basis, This was achieved primarily by minimising air travel and providing extensive opportunities for mobile working.

At product level, KGAL adheres to industry standards including GRESB, and – if formal standards do not yet exist – works with expert partners to develop bespoke assessment methods. It excludes direct investments in fossil fuels by investment funds managed by KGAL as a matter of principle. The company’s overall annual sustainability report and specific reporting for specific products or assets ensure transparency to clients and other stakeholders.

The investment portfolio managed by KGAL of more than EUR20bn encompasses real estate, aviation and renewable energies. The latter investments produce over 2 TWh of green electricity per year and supplies approximately 1.5m people. As part of its ongoing sustainable growth strategy, the business intends to substantially increase the amount of green energy generated by the managed investment portfolio.

Across all asset classes, the company considers climate-related aspects in its risk and investment processes, and has developed a holistic range of measures to realise its climate goals. All measures are based on five key principles: measure, integrate, reduce or avoid, compensate and disclose.

Gert Waltenbauer comments: “KGAL has had a longstanding commitment to sustainability. We are proud of our progress in limiting our carbon footprint but realise we must do more”.

Robert Sattler, Sustainability Officer of KGAL Group, adds: “Our new climate-neutrality targets and the publication of our overall climate strategy underline our ambition to contribute to holistic solutions for the challenges of today and tomorrow.

“Our latest UN PRI rating shows that we are on the right track and we will continue to increase our efforts in this extremely important area of our business”.

More information on KGAL’s commitment to sustainability and its new climate strategy, can be found here.