Choose between news, insights and events, and filter by topic.

News

Aviation

Aviation

Sustainable Infrastructure | Company

KGAL honoured with the Scope Award in the “New Energy” category for the third time in a row

Sustainable Infrastructure

Sustainable Infrastructure

PtX Development Fund by KfW and KGAL makes first contribution to Egyptian hydrogen project

Sustainable Infrastructure

KGAL ESPF 6 participates in the development of one of Europe’s most important hydrogen hubs

Sustainable Infrastructure

KGAL ESPF 5 completes acquisition of a solar park cluster in Saxony-Anhalt with a total capacity of 120 megawatts

Real Estate

Sustainable Infrastructure

Debut: Impact fund KGAL ESPF 5 acquires its first solar park in the Czech Republic

Real Estate

Sustainable Infrastructure

KGAL ESPF 5 enters into joint venture for the development of battery storage systems in Italy

Sustainable Infrastructure | Real Estate | Company

Sustainable Infrastructure

Real Estate

Real Estate

KGAL creates almost 20,000 square metres of high-quality living space for Regensburg with the “KönigsTOR” residential quarter

Sustainable Infrastructure

KGAL again honored at the Scope Awards 2024: Best Asset Manager in the sector “INFRASTRUCTURE EQUITY – NEW ENERGY”

Sustainable Infrastructure

Sustainable Infrastructure

KGAL wins internationally tendered mandate to manage KfW’s PtX Development Fund for the promotion of green hydrogen

Sustainable Infrastructure

Sustainable Infrastructure

New Green Hydrogen fund KGAL ESPF 6 invests in Arcadia eFuels climate-neutral e-kerosene production facility

Company

KGAL announces new dual leadership team and forward-looking corporate strategy

Sustainable Infrastructure

Green Energy Fund KGAL ESPF 4 completes investment phase with EUR 1.3 billion. Successor ESPF 5 increases return forecast.

Sustainable Infrastructure

Sustainable Infrastructure

KGAL and Lafarge sign 15-year power purchase agreements for two wind farms in Poland

Real Estate

Real Estate

KGAL sums up 2022 – a year of surging interest rates and exceptional performance

Real Estate

New impact fund KGAL Core 5 LIFE reaches first closing and acquires sustainable residential property in Málaga

Sustainable Infrastructure

KGAL and PFALZSOLAR join forces to build solar parks in Greece with a total capacity of 176 megawatts

Real Estate

KGAL´s neighbourhood quarter “Perlach Plaza” in Munich gets off to a flying start

Company

Sustainable Infrastructure

KGAL and EIT InnoEnergy establish strategic cooperation in green hydrogen sector

Sustainable Infrastructure

KGAL and project developer Premier establish joint venture for solar and wind power in Spain

Real Estate

KGAL and Pfalzwerke AG collaborate to offer fast-charging EV columns at the “Das Waibl” specialist retail park in Waiblingen

Sustainable Infrastructure | Company

Sustainable Infrastructure

KGAL Research: Green hydrogen is key for climate protection and energy independence

Real Estate

Real Estate

Real Estate

KGAL sells Telekom headquarters with around 81,000 sqm on behalf of South Korean institutional investors

Sustainable Infrastructure

Sustainable Infrastructure

Sustainable Infrastructure

KGAL acquires majority stake in Italian solar and wind developer for impact fund KGAL ESPF 5

Real Estate

Real Estate

KGAL celebrates its debut in Brussels with purchase of the Stéphanie’s ensemble

Real Estate

Aviation

KGAL launches aviation fund APF 5 as single account with a German pension fund

Real Estate

Real Estate

Sustainable Infrastructure

KGAL acquires 50 percent stake in renewable energy project developer GP JOULE Projects

Sustainable Infrastructure

KGAL Impact Fund ESPF 5 hits first close at over 50 percent of total equity target

Sustainable Infrastructure

Sustainable Infrastructure

KGAL seizes market opportunity with launch of first Impact Fund under Article 9 as part of its continued expansion in the renewables market

Real Estate

Company

AM VENTURES launches 100-million-euro venture capital fund dedicated to industrial 3D printing

Company

Company

Company

Real Estate | Company

Sustainable Infrastructure | Company

Company

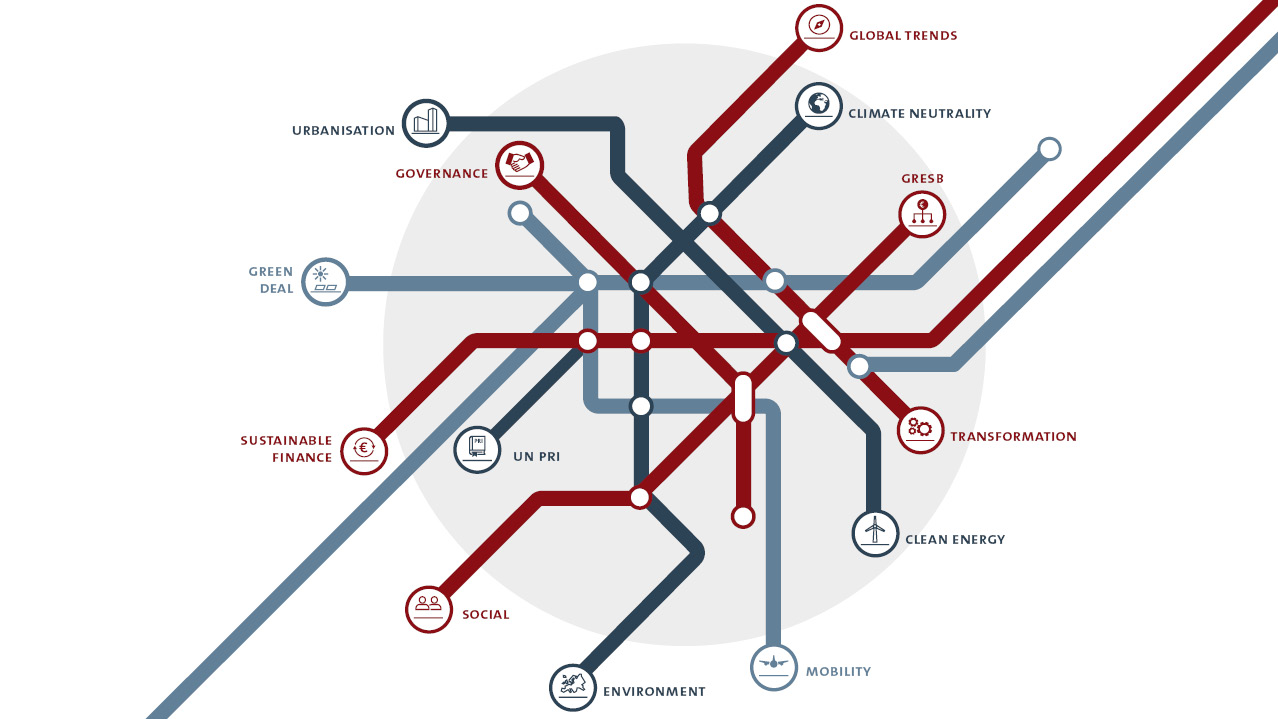

New UN Priciples for Responsible Investment assessment enhances KGAL ESG rating

Sustainable Infrastructure

KGAL enters the Polish renewables market with a photovoltaics joint venture and the purchase of two wind farms

Company

Sustainable Infrastructure

Company

Company

Real Estate

Company

Insights

Sustainable Infrastructure | Real Estate | Company

Real Estate

Sustainable Infrastructure

Company

KGAL announces new dual leadership team and forward-looking corporate strategy

Meet us at the following events

Contacts

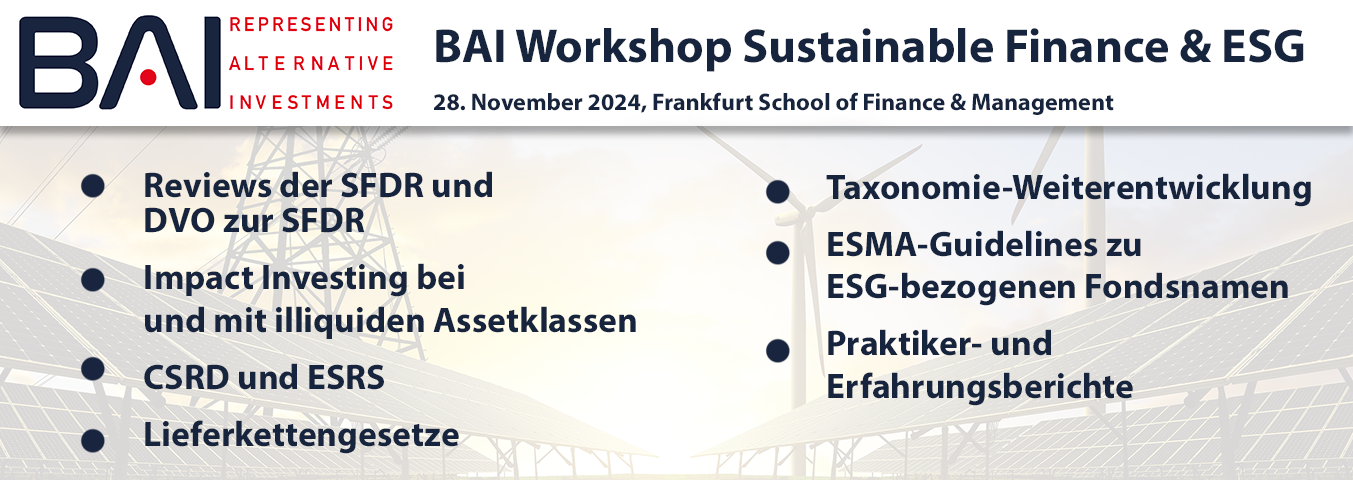

28 November 2024 - 09:00 am / Frankfurt

28 November 2024 - 09:00 am / Frankfurt